JoyBuy — JD.com’s Play for European Growth

Late last year, several new European retail websites completed testing phases and readied themselves for full launch under the banner of JoyBuy. These online operations are the latest attempt by the Chinese retail giant JD.com to achieve growth in the European retail market, and have launched in selected markets – Germany, the UK, France, the Netherlands, Belgium, and Luxembourg.

A decade ago, the JoyBuy brand was a direct competitor of AliExpress, offering cheap, cross-border fulfilment. However, this new push by JD.com is of a very different nature. Rather than following brands such as Shein and Temu, the new JoyBuy stores are leveraging its parent companies core strengths in its home market – fast delivery and brand reliability, both things that are more in line with standard European customer expectations.

With its recent purchase of German retail group Ceconomy, the owner of MediaMarkt and Saturn, JD.com has gained access to established customer bases, networks of physical stores, and logistics chains. This acquisition has also gone hand in hand with the expansion of Jingdong Logistics, its third-party logistics offering on the continent.

So what does this expansion look like? We reviewed the JoyBuy.co.uk store (still in Beta) to see what the new site offers.

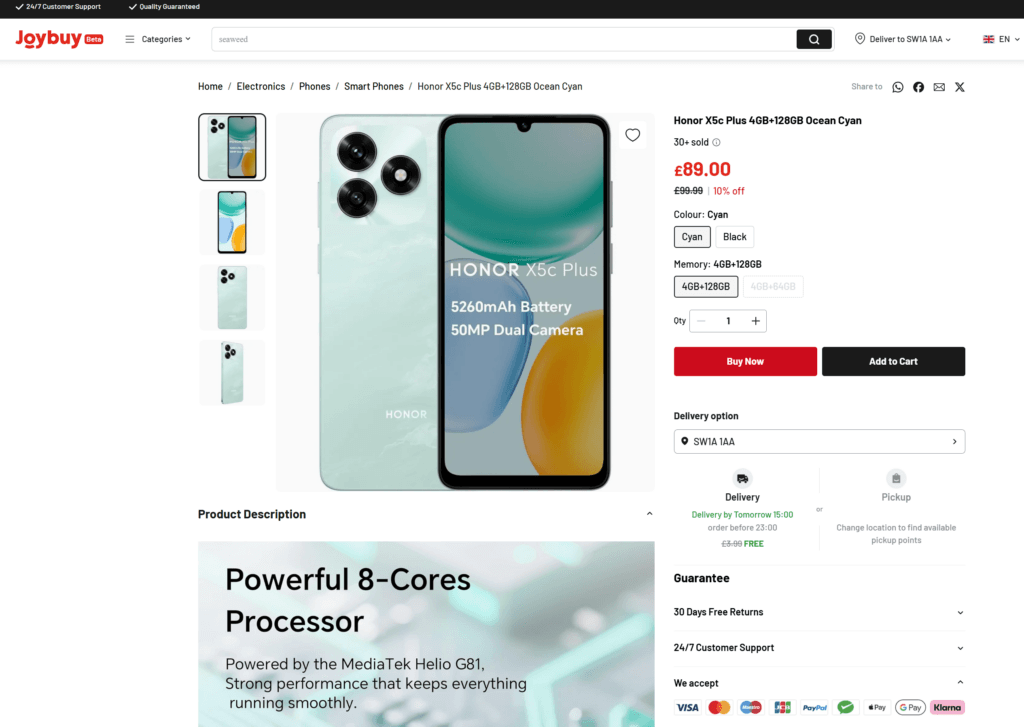

Currently the layout is light and simple, focusing mainly on listings of products. The products themselves are a mixture of a limited range of familiar international brands and a selection of Chinese and Asian products, ranging from consumer electronics to Toys and Beauty products.

Interestingly, there seems to be a notable selection of frozen food items that are offered for delivery, as well as (notably) a selection of Morrison’s branded products, suggesting some form of link-up between the new retailer and the British supermarket. Morrisions were a key partner for many of Amazon’s grocery offerings in the UK, so seeing over a thousand of their items listed here feels significant.

The product pages themselves are quite basic, with a single Product Description space on the page that appears to contain most content types, from bulleted features to lengthy “A+” imagery. However, viewing multiple pages suggests a lack of consistency in how this space is utilised, with most brands offering little more than a paragraph of text, bullet points and occasional technical specifications. However, video content can be integrated into the product image gallery, and set to play automatically upon visiting the page for the first time.

On the homepage there’s a clear focus on offers to bring in customers – both welcome offers and limited-time “lightning deals” are given prominence – but even though the product selection feels very limited, the vast majority are from recognised brands, which makes for a difference shopping experience than you would often find on Amazon sites in recent years.

The foundations are clearly in place, but it remains to be seen how JoyBuy intends to mature and grow, especially given the potential leveraging of the Saturn and MediaMarkt brands that are now at their disposal. In the meantime, we’ll be doing our best to dig into the specifics of JoyBuy and how product listings and content work on their platform.

For more online retail news and analysis, be sure to sign up for our newsletter or join the Product Detail Page Group on LinkedIn.